Introduction

Few books have had as profound an impact on the way we understand human behaviour, especially in the context of decision-making, as Thinking, Fast and Slow by Daniel Kahneman. Published in 2011 and based on decades of psychological research (including his work resulting in the Nobel Memorial Prize in Economic Sciences in 2002 which honoured his integration of psychological insights into economic science), the book explores how our minds work, how we make choices, and why we often get it wrong.

This is not a typical business or investing book. It’s about the mental machinery behind every financial decision: why we act irrationally, fall for patterns, overestimate our knowledge, and misjudge risk. For anyone interested in improving their thinking, Thinking, Fast and Slow is essential reading.

Summary of the Book

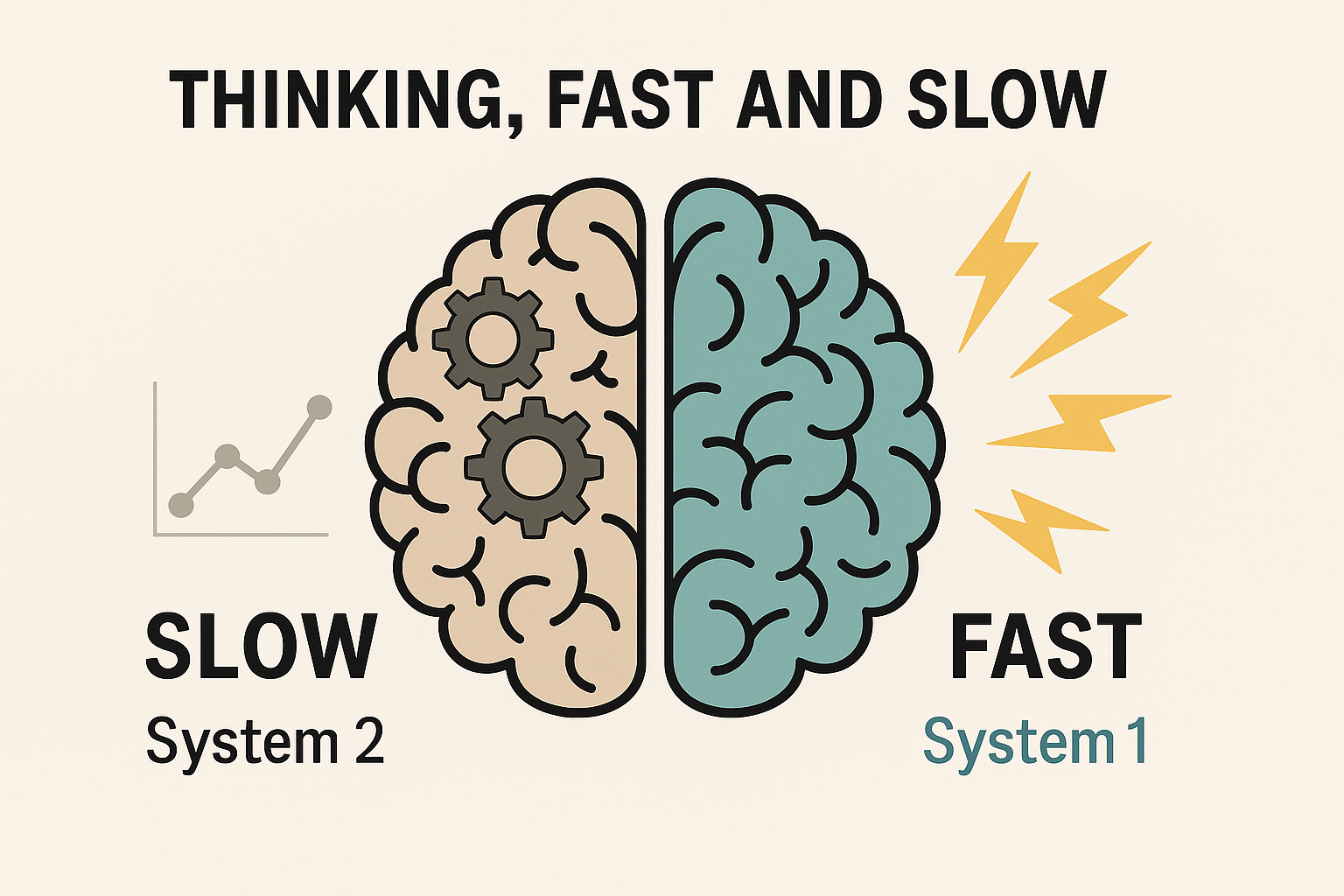

Kahneman introduces two systems of thought:

- System 1: Fast, intuitive, automatic, and emotional. It’s the part of the brain that jumps to conclusions, makes snap judgments, and fills in gaps.

- System 2: Slow, deliberate, logical, and effortful. It checks facts, weighs evidence, and does the “hard work” of thinking.

Throughout the book, Kahneman illustrates how these two systems interact and often conflict when we make decisions. He dives into dozens of cognitive biases and errors, such as:

- The anchoring effect

- Loss aversion (a key element of Prospect Theory developed by Kahneman and Tversky)

- The availability heuristic

- Overconfidence bias

- The planning fallacy (a subtype of overconfidence bias)

What makes the book especially powerful is how it blends psychology with real-world examples from economics, medicine, and everyday life – including investing.

Key Takeaways

System 1 vs. System 2

We rely more on System 1 than we think. It’s quick and efficient, but also prone to error. Good decision-making requires learning to engage System 2 more often especially in high-stakes situations. System 2’s “laziness” exacerbates reliance on error-prone System 1.

Cognitive Biases Are Everywhere

We’re not as rational as we like to believe. Our judgments are shaped by subconscious shortcuts, many of which lead to predictable errors in perception, memory, and risk assessment.

Loss Aversion

People fear losses more than they value equivalent gains. This explains many investing mistakes, like panic selling or holding losers too long.

Overconfidence Is Dangerous

We tend to overestimate our knowledge and ability to predict the future. This often leads to poor financial decisions, especially among individual investors.

The Planning Fallacy

We habitually underestimate how long tasks will take and how much they will cost because System 1 focuses on optimism and best-case scenarios.

What I Liked

- Eye-opening insights: This book fundamentally changes how you view your own thinking.

- Real-world relevance: Every concept has applications in investing, leadership, planning, and personal finance.

- Scientific yet readable: Despite being deeply rooted in research, the storytelling and examples make it engaging.

Limitations or Challenges

Dense content: Like The Intelligent Investor, this is not a casual read. Some chapters are intellectually demanding and require multiple readings.

- Repetitive at times: Certain themes are revisited several times, which may feel redundant.

- Few practical solutions: Kahneman is more focused on diagnosis than prescriptions. You’ll understand your mental flaws, but you won’t always know how to fix them. Although, he suggests mindfulness and breaks to engage System 2.

Application to Long-Term Investing

At StoffelWealth, we often talk about behavior being as important – if not more important – than strategy. This book provides the psychological blueprint behind that idea. Understanding the limitations of your own thinking can help you:

- Resist market hype and fear cycles

- Stick to your long-term investment plan

- Build discipline around rebalancing and risk management

- Make better decisions under uncertainty

Whether you’re managing a diversified portfolio, evaluating asset classes, or rethinking your goals, Thinking, Fast and Slow helps you become a more reflective and resilient investor.

Final Verdict

Rating: 5/5 – A Modern Classic on Decision-Making

Thinking, Fast and Slow is one of those rare books that changes how you see the world – and yourself. If you want to better understand why you make the choices you do (and how to make smarter ones), this book is an indispensable guide.

Recommended for:

- Investors seeking to improve their behavior and self-awareness

- Anyone in a decision-making or leadership role

- Readers curious about psychology, behavioral finance, and human nature

Not recommended for:

- Readers looking for light, quick reads

- Those who want simple hacks instead of deep understanding

Closing Thought

“Nothing in life is as important as you think it is, while you are thinking about it.”

Daniel Kahneman

Mastering your mind might just be the most powerful investment you can make.