If Investors want to earn expected returns higher than the riskless rate, the most reliable way is to bear risks that markets reward with a premium. A less reliable way is to pursue active management, in which successful investors (skillful or lucky) reap gains at the expense of their less successful peers.

Risk Premia Harvesting

Understanding Risk Premia

There are two ways for you to make money in financial markets: (1) by investing and staying invested in risk premia for a long period of time or (2) by active trading to exploit market inefficiencies. The focus of this article is on risk premia harvesting.

According to Investopedia, a risk premium is the return in excess of the risk-free rate of return that an investment is expected to yield.

Any asset with underlying systematic risk is expected to carry a premium rewarding investors who are willing to take on that risk. Being constantly exposed to risk premia by holding risky assets will pay off on average in the long run. It is worth noting that idiosyncratic risks should not carry a reward as they can be eliminated by diversification.

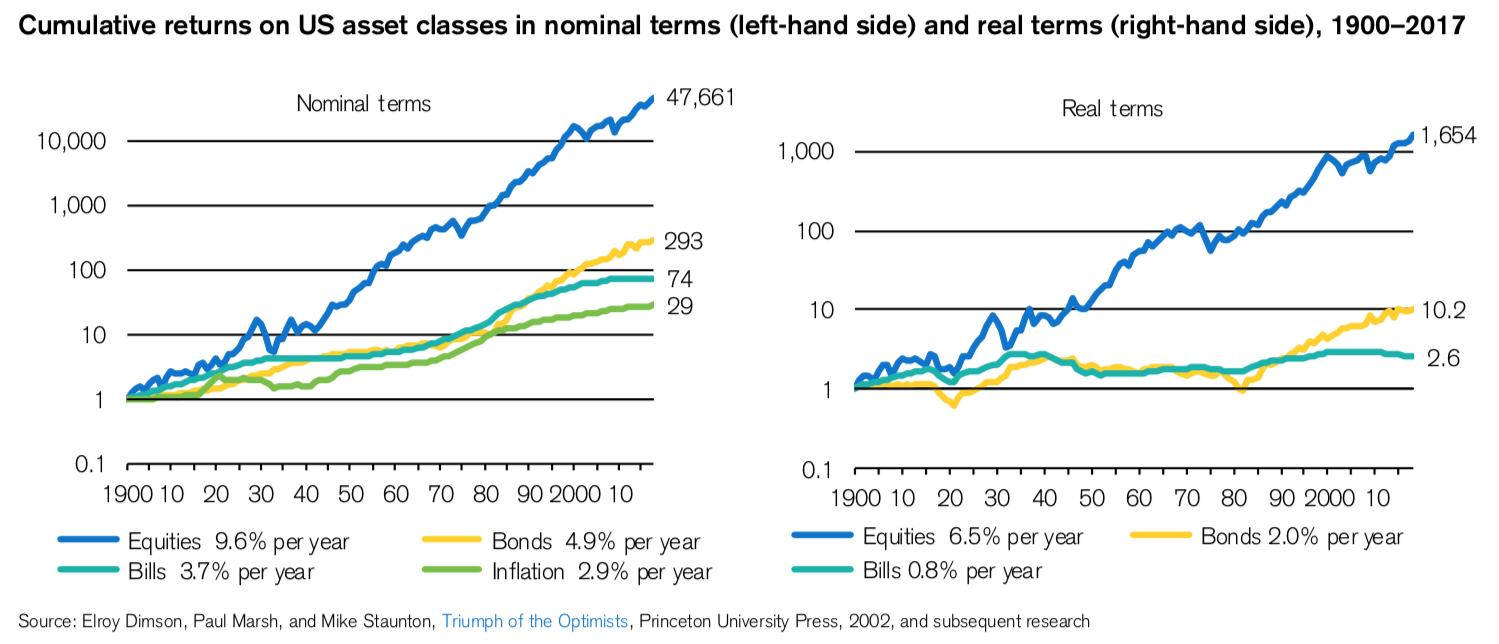

Let’s looks at some historical data from the United States:

And there you have it. Maintaining a constant allocation to major asset classes such as US equities and US bonds will yield constant returns for its investors over time. Easy, right? Or “easy-peasy lemon squeezy don’t forget your macaroni” as my son would say.

Well, you probably already guessed it. It’s not that easy… Because we are humans with all our pesky biases and emotions influencing our behaviors and decision making.

From the above chart it is obvious that asset prices and returns are trending upwards. However, when you zoom into the timeline you will find significant declines in the asset prices. Let’s look at the S&P 500 index early 2020 when the Covid-Pandemic hit our planet:

The index tanked 35% during February and March 2020. As they saying goes, stocks take the stairs on the way up and the elevator on the way down. Experiencing significant drawdowns is tough and uncomfortable. This is the worst time to panic. You are getting paid to endure this volatility and not give in to uncertainty and fear. In times like these it is crucial to remind yourself about your investment principles and why you invested in risk premia in the first place.

These are the times to become greedy. I remember that I started buying quite early in March 2020 and I had quickly used up my dry powder. At that moment I had doubts whether that was a good idea to buy so aggressively as there was still a huge amount of uncertainty how the pandemic will play out. But as you can see, the recovery was almost as fast as the decline. It is important to highlight here that my buying early was pure luck. There is zero market timing skill involved here and only in hindsight it has become clear that it was the right decision.

Let’s look at the 2008 Global Financial Crisis (GFC) as another example. In this event the drawdown was even larger at more than 50% and the recovery phase took a long time:

Individual assets from different asset classes such as stocks, bonds, REITs, etc. are exposed to various risk factors.

Risks factors:

-

Inflation risk

- Real interest rates risk

- Credit risk

- Liquidity risk

- Economic growth risk

- (Geo)political risk

- Currency risk

- …

When buying assets such as stocks or bonds you are “buying” a subset of those risk factors. The objective is to construct a portfolio of assets in such a way that you are exposed to risk premiums which have been rewarded in the past and are expected to also be rewarded in the future. Furthermore, the assets must be diversified enough to minimize exposure to unrewarded risks (idiosyncratic risk).

Risk Premia harvesting has been and will continue to be the main element of my portfolio. Asset selection is already 80% of this game. All you have to do is show up and participate. The easiest way to achieve a diversified portfolio across multiple asset classes is to buy highly liquid Exchange Traded Funds (ETF) with low expense ratios that can be traded just like an individual stock on a stock exchange.

I will delve deeper into this topic in future articles to address certain considerations such as dollar cost averaging and trading cost, asset rebalancing, and hedging against market crashes.