Tariffs, Tumult, and Staying the Course: A Note to Long-Term Investors

Markets are down. Headlines are loud. Uncertainty is abundant. But for long-term investors, this is not the time to panic.

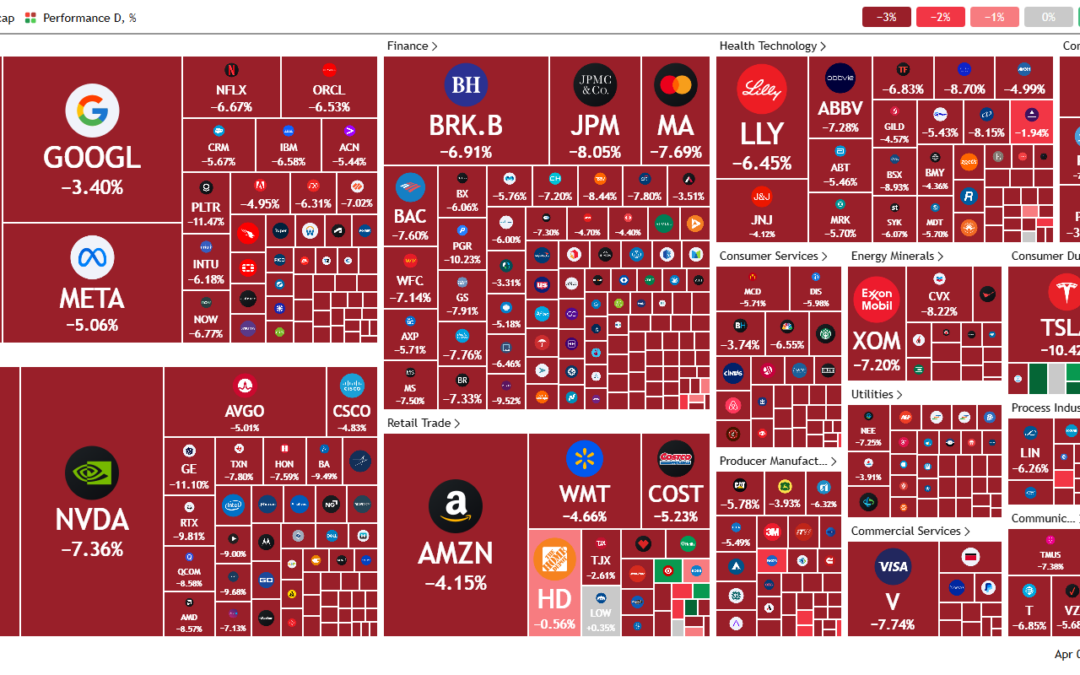

In response to a new wave of global tariffs announced by the Trump administration, markets around the world have reacted sharply. Stocks are falling, volatility is rising, and news feeds are once again filled with fear and speculation.

Let’s pause, breathe, and remember a core principle of investing: volatility is not the enemy, emotional reactions are.

What’s Happening Now?

The U.S. administration has introduced another round of trade tariffs, triggering immediate responses from global partners and sparking fears of escalating trade tensions. Unsurprisingly, equity markets have reacted with concern. Major indices are down, investor sentiment has taken a hit, and many retail investors are asking the same question:

“Should I sell now before it gets worse?”

Here’s a simple answer: probably not.

A Long-Term Perspective

If you’re investing for the long haul – years, even decades – then short-term political moves and market reactions are part of the journey. They are not a signal to abandon your plan.

History reminds us that:

- Markets overreact in the short term

- The world is full of unpredictable events

- Over the long run, investors who stay disciplined and keep buying are usually rewarded

During the financial crisis in 2008, the eurozone crisis in 2011, Brexit in 2016, and the pandemic crash in 2020, people were panicking. And yet, those who stayed the course and continued to invest saw significant gains in the years that followed.

Why Selling Now Can Be a Mistake

Many investors believe they can “get out now and get back in later.” But that’s a dangerous game.

- You have to be right twice: when to get out, and when to get back in.

- Market bottoms are only visible in hindsight.

- Most of the market’s best days happen near its worst days.

Missing just a few of those big up days can destroy your long-term returns. I have previously written a post on market timing and why it rarely works. This is a good time for a refresher.

Look for Buying Opportunities Instead

If anything, this may be a time to rebalance or buy, not to sell. When markets drop, assets become cheaper. If you’ve been waiting for better entry points, this ongoing market decline is your friend, not your foe.

Ask yourself:

- Are the businesses you hold still fundamentally strong?

- Are your financial goals still the same?

- Has your time horizon changed?

If the answer to those is no, then your investment plan probably doesn’t need to change either.

Your Edge Is Your Behavior

The truth is, long-term investors don’t need to predict the next move. You need to behave well when everyone else is losing their cool. This is where your real edge lies.

- Stay diversified.

- Stick to your risk allocation.

- Keep investing on a schedule.

- Tune out the daily noise.

Final Thoughts

Global trade disputes and political headlines will come and go. So will market dips, corrections, and bear markets. But wealth is built by showing up, through both good times and bad.

This is not a call to ignore risk – but it is a reminder to stay grounded. Selling in panic rarely ends well. Staying invested, on the other hand, is what compounding was made for.

If anything, this may be one of those times when patience and courage pay off later.

So don’t panic. Don’t chase headlines. And most importantly, don’t forget why you started.

“I think you can argue that if you are not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder and you deserve the mediocre result you’re going to get.”

Charlie Munger

Investor Calm Checklist

Download this simple “Investor Calm checklist” which you can modify to your liking and keep visible during times like these.