Do You Gamble? The Fine Line Between Investing and Speculation

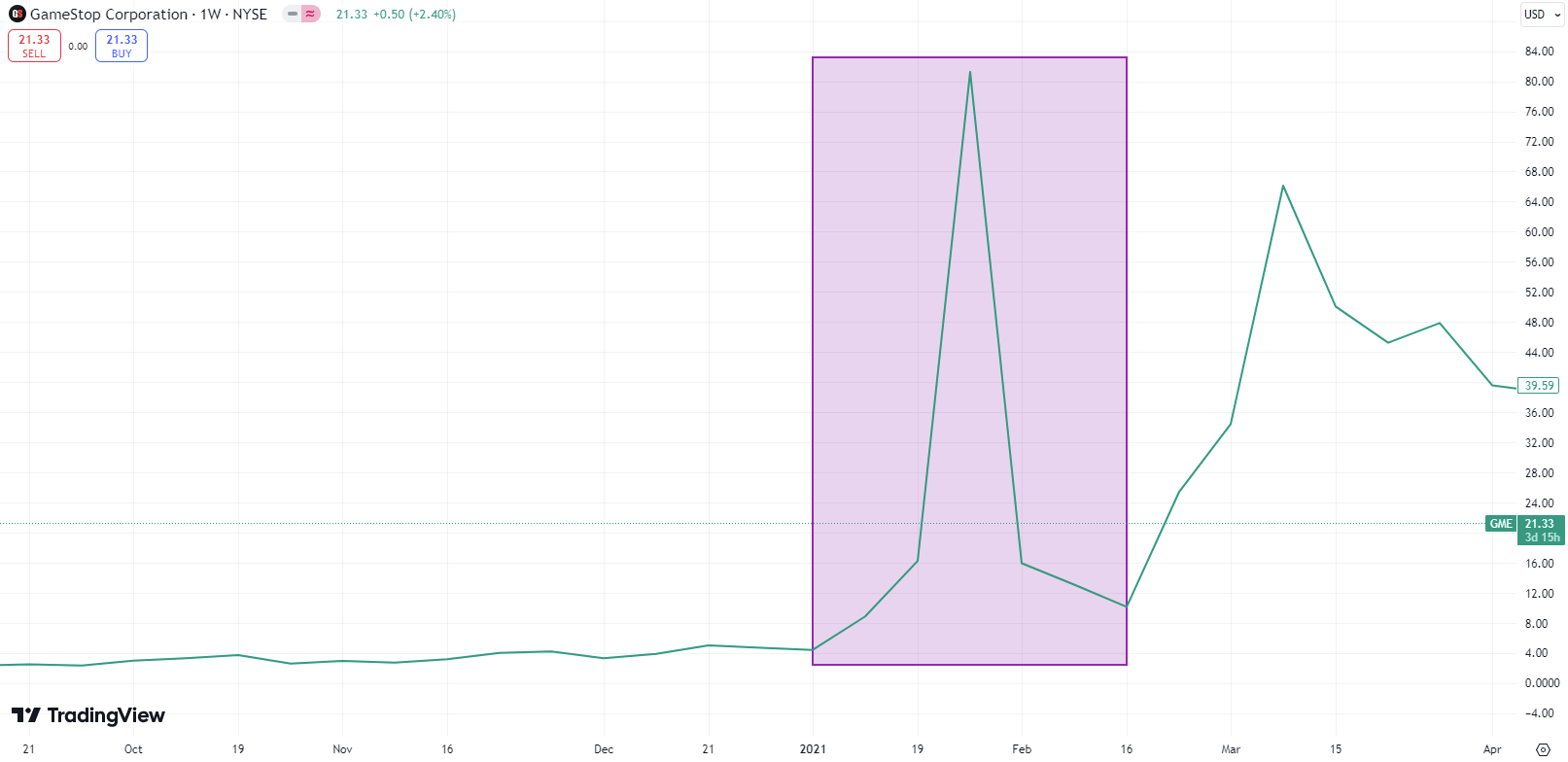

Many people lost lots of money in the past “investing” too much of their money into perceived lucrative opportunities. Think Gamestop. During the GameStop short squeeze in early 2021, many retail investors rushed to buy GME shares as the stock price soared due to the short squeeze initiated by Roaring Kitty and Reddit’s r/WallStreetBets community. The price skyrocketed in a matter of weeks, fuelled by FOMO and speculative trading:

Many individual investors jumped in at the peak, hoping to capitalize on further price increases. However, when the stock price dropped back down as the volatility settled, numerous investors who bought at the peak suffered heavy losses. In some cases, individuals invested their life savings into the stock without understanding the extreme risk, leading to financial ruin when the price collapsed.

A sudden craze has the power to turn otherwise rational and intelligent individuals into greedy gamblers, losing much of their hard-earned money on one single risky bet. That’s why get rich quick schemes work…

Does this mean I would never put money into a risky gamble? Absolutely not. I certainly like the occasional gamble, but I would never put a significant amount of money into any of those bets and I accept that I might lose some or all of the invested money.

Examples that turned out to be profitable

These are some examples of past gambles that were profitable:

- Deutsche Bank during the GFC: there was no research into Deutsche Bank before I bought a few shares. All banks were beaten down during this time and my decision to invest was purely based on the assumption that the German government will not let this bank fail:

- Singapore Air during the Covid-19 pandemic: Singapore is a small country and does not have a domestic market. Its national airline Singapore Air therefore only operates international flights. When international flights were suspended, Singapore Air was not able to operate any flights:

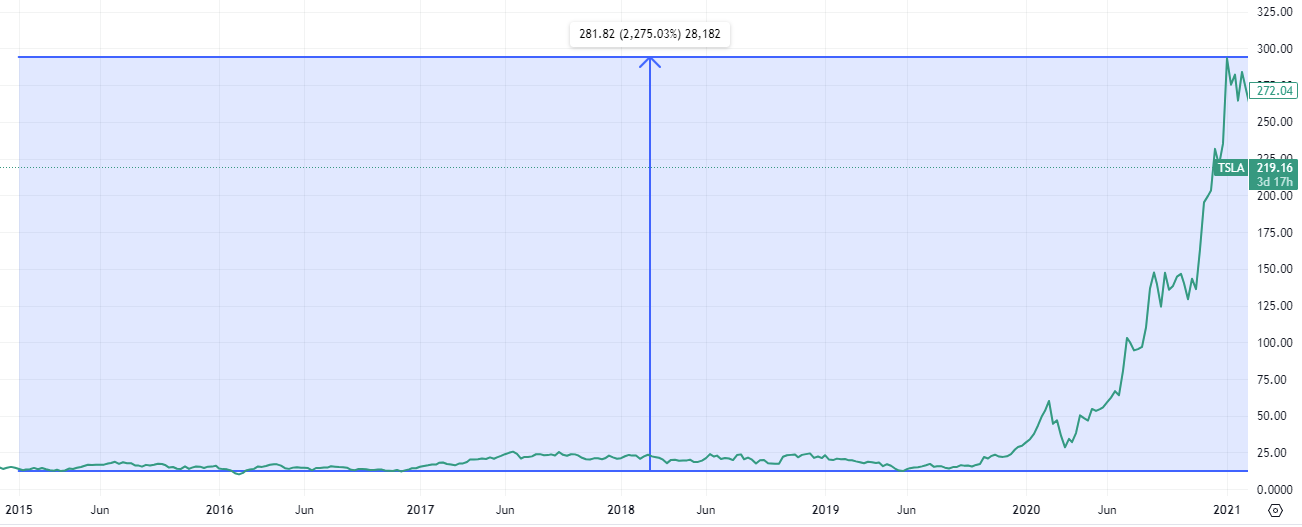

Here is an example of a large-scale gamble: a colleague of mine was retrenched from the company in 2015. They gave him a suitcase full of money and he put the entire amount into Tesla shares. He told me about this in a brief interaction on LinkedIn in January 2021 sharing that he is enjoying his life, luck, and freedom.

At that point he was up more than 2,200% – YOLO:

Would you have done that? I know I wouldn’t have. As a classic risk premia harvester, I would have spread my bets as usual avoiding too much weight on individual stocks in my portfolio. Obviously, you would not get a payoff like that by spreading your bets, but I would not want to take a risk of putting a significant amount of my available capital into one single stock. What if he had decided to put all his money into a different stock at this time and lost most of it? There is plenty of examples where things went the opposite way.

Anyone remember Wirecard?

Compare the Tesla chart with the Wirecard chart during the same period from 2015 – 2021 and you get the idea:

If it goes well, congratulations. If not, accept it and move on. But don’t fall into this common pattern:

- “I made a big profit on this trade; I am a great trader”

- “I made a big loss on this trade; it’s the market’s fault”

As my ex-colleague said it: he cannot believe how lucky he was. And that’s exactly what it is: luck. Enjoy the profit when it goes well, don’t blame others for your losses if it goes wrong. Before you put a single dollar into any such gamble, decide if this is for you. Only use money you can honestly afford to lose and accept that you might lose some or all the investment. Do not add more money to a losing trade and gamble away your kids’ education fund. Define what is an insignificant amount of money for you considering your circumstances before you decide to buy anything.

A new gamble

Having said all that, I have been thinking about placing a new bet: Atos.

Atos is a French multinational company specializing in digital transformation solutions and IT services. Founded in 1982 and headquartered in Bezons, France, Atos operates globally, offering services that include advanced computing, artificial intelligence, cloud solutions, cybersecurity, and digital consulting. The company serves a wide range of industries, including financial services, healthcare, manufacturing, public sector, and telecommunications. Atos is also known for its work in quantum computing and its role as a key technology partner for events such as the Olympic Games.

Despite its broad range of services and market presence, Atos has faced significant financial challenges in recent years, reporting substantial losses due to restructuring efforts, impairments, and declining revenues. In 2023, Atos reported a revenue decline to €10.69 billion and an even larger loss of €3.44 billion. The company has been undergoing major transformations, including selling off key assets to stabilize its finances and refocus its business strategy.

So far this has not positively impacted its share price. Here is the chart:

The primary reason I am interested in placing a small bet on Atos is the fact that they provide and manage mission-critical systems for the French government and defense customers giving a strong incentive to ensure the survival of this company:

The beleaguered French IT group received a 700 million-euro ($768.4 million) offer from Paris back in June for its advanced computing, mission-critical systems and cybersecurity activities within Atos’s big data and security arm, underscoring efforts from France to prevent the collapse of a company that offers services to governments, homeland security and defense clients (source).

So, I’m going ahead and buy 1,000 shares worth around EUR 675 today:

Let’s see where this goes!

UPDATE 14 May 2025:

Well, that was a dud! Am I bothered about it? Nope! Will I try similar gambles in the future? Yup! My wife properly outperformed me in this trade. While I took a total loss, she was more patient, entered later and walked away with a 87% profit!