Build a Simple Risk Premia Portfolio: Getting Started Guide

Part 1: Recap of Risk Premia Harvesting

As described in a previous post, Risk Premia Harvesting is a very accessible trading strategy for any retail investor and does not require a lot of effort to get going and keep going. As highlighted there, the most important element of benefiting from this strategy is to just show up, select a small number of suitable assets, and go long. Add to that a bit of periodic rebalancing and you will get a long way with this strategy. With 20% input you can achieve 80% output.

Risk Premia Harvesting is based on the principle that risky assets such as stocks trade at a discount to their expected future cashflows. For example, bonds pay coupons to the bondholders, and companies generate profits for their shareholders. This is where the excess returns will come from when you are holding on to these risky assets, such as equities, in the long run and your expected returns are higher than owning an equivalent safer asset, such as government bonds, instead.

By diversifying your Risk Premia portfolio across different asset classes and geographies you can achieve an exposure to a variety of risk factors which will impact the cashflows of your assets depending on the current economic regime.

All asset classes have good and bad economic environments and one famous example of a strategy aiming to combine all of those into one portfolio is the Bridgewater Associates’ “All Weather Strategy”. Ray Dalio, the found of Bridgewaters Associates, his co-Chief Investment Officer Bob Prince and other team members asked themselves: “what kind of investment portfolio would you hold that would perform well across all environments, be it a devaluation or something completely different?”

Dalio is big on market cycles, and I like to occasionally revisit his video on “how the economic machine works”:

If you prefer reading about market cycles, you might want to have a look at “Mastering the Market Cycle: Getting the Odds on Your Side” by Howard Marks.

Part 2: A Basic Risk Premia Portfolio

Let’s look at an example of how a basic Risk Premia strategy could look like: to keep things simple at first, we will select only 2 assets for our portfolio: stocks and bonds. More specifically, US equities and US long-term government bonds, which will give us exposure to risk factors such as interest rates, inflation, and growth (among others). Now that we have selected our universe, we can simulate how this portfolio would have performed in the past.

Initially, we will start with a classic allocation of 60% equities and 40% bonds, and we will not rebalance the portfolio over time.

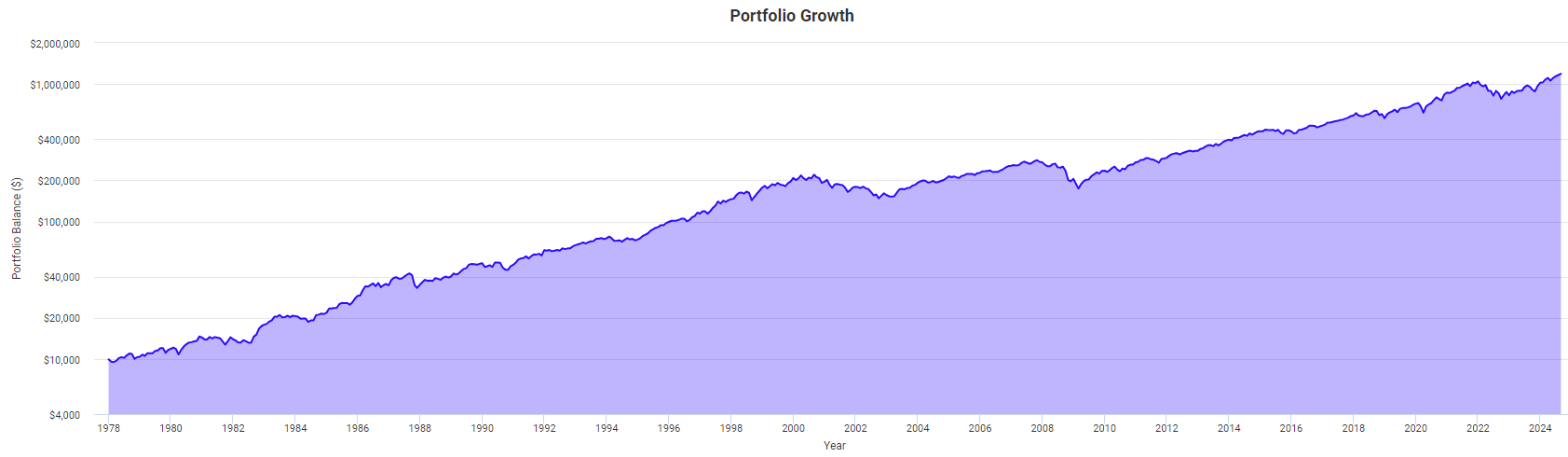

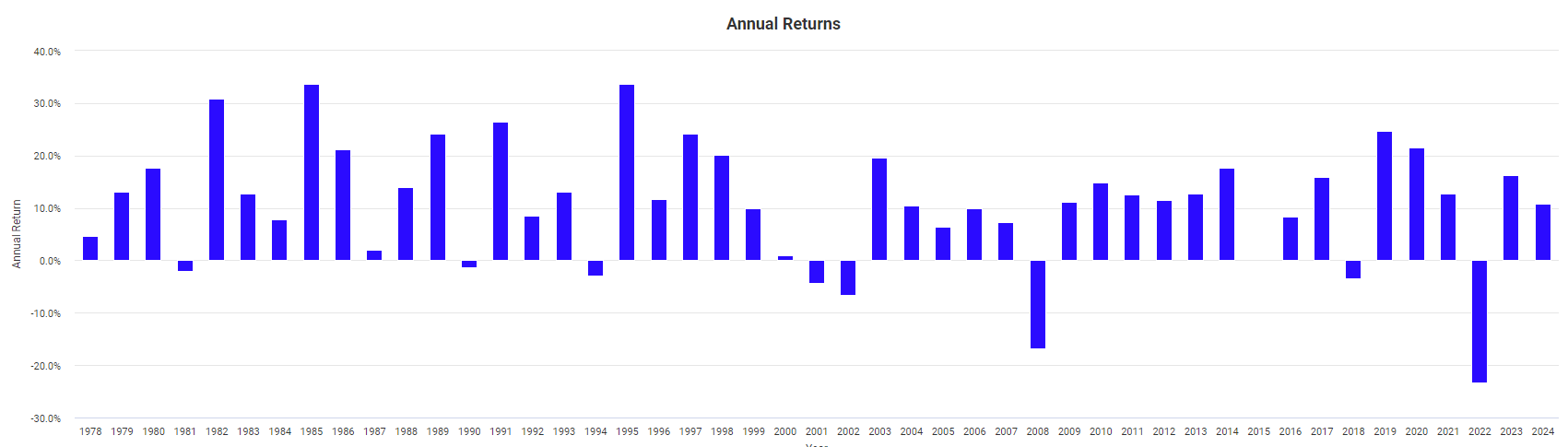

Here is the resulting portfolio growth and annual returns:

We see constant growth with the occasional drawdown, especially in 2022 which was a bad year for risk premia. Pretty ok, right? Especially considering we have not had to do anything since the initial investment to achieve this gain:

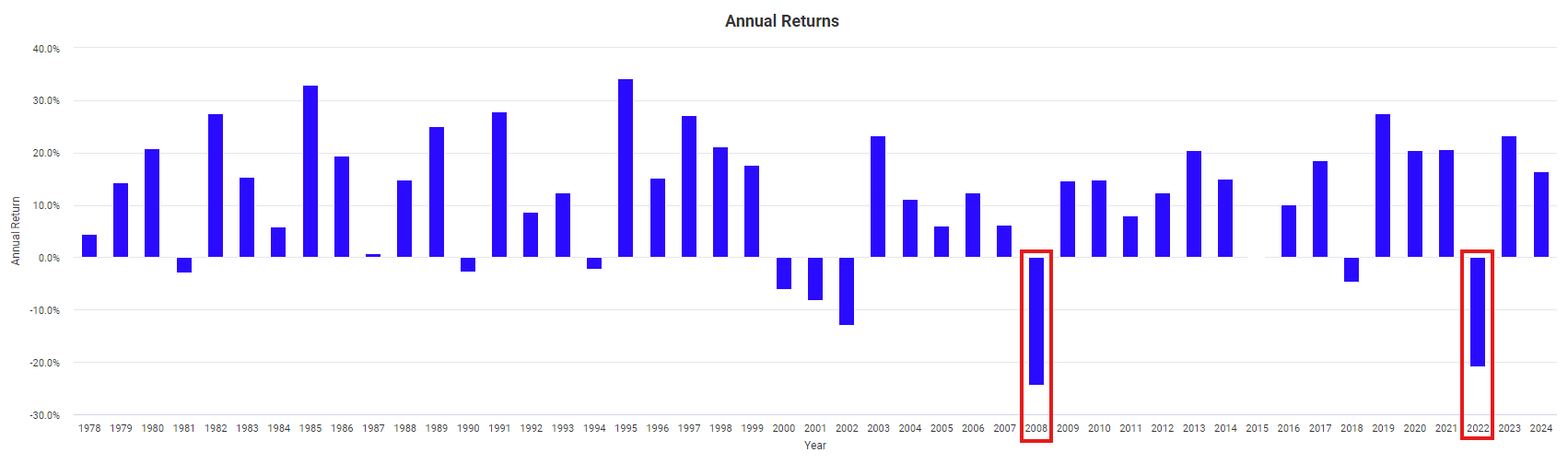

But there is one issue that is not visible in the chart above: the allocation drift. We started with a 60% allocation to equities and a 40% allocation to government bonds. Over time this ratio has changed dramatically, and the portfolio is now dominated by equities. At the end of the simulation more than 90% of the portfolio capital is in equities with less than 10% remaining in government bonds:

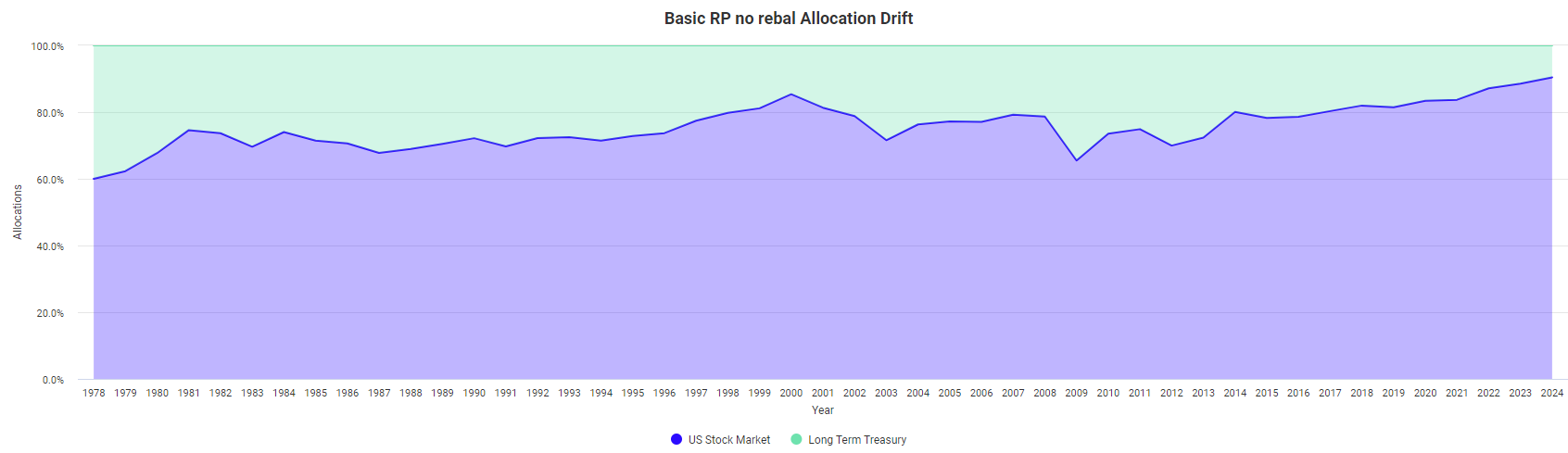

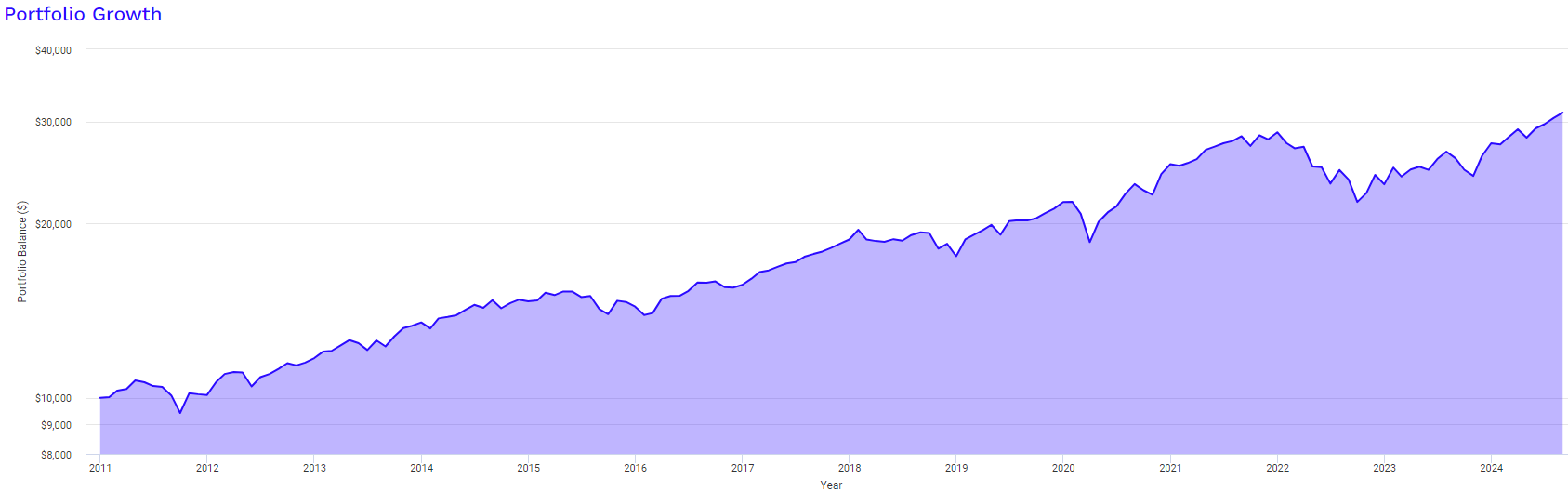

Let’s repeat the simulation with the same assets and initial 60:40 allocation but this time we rebalance the portfolio monthly back to the target allocation. Here is the resulting portfolio growth and annual returns:

We see similar portfolio growth and annual returns but slightly less due to the monthly rebalancing back to the target 60:40 allocation reducing the dominance of the equities portion. We also see a reduced volatility and reduced drawdown thanks to the constant allocation to the different risk premia:

Part 3: Practical considerations and how to trade the strategy

There are a few things to think about if you want to trade this strategy:

- The asset selection (universe)

- The asset allocation or how much of your capital to be invested in the various assets

- Portfolio sizing

If you focus on these things, you will already be in a good place.

Let’s start with the universe. While investing in US equities and US long-term government bonds has historically been profitable, you might want to expand your universe of assets to invest in to increase your exposure to various risk factors and at the same time diversify your risk. Remember your objective is to maximize exposure to assets that are likely to reward you with excess returns.

Potential candidates for your universe could be:

- US equities

- US government bonds with various durations

- International equities from Developed and Emerging Markets

- Emerging Market bonds

- Commodities (e.g. gold)

- Real Estate Investment Trusts (REITs)

You need to decide which of these candidates should become part of your portfolio and then select suitable low-cost Exchange Traded Funds (ETFs) which physically replicate each asset class. For example, for US equities you might consider one of the following 2 ETFs:

- SPDR S&P 500 ETF Trust (symbol: SPY)

- Vanguard Total Stock Market Index Fund ETF (symbol: VTI)

Personally, I prefer VTI over SPY because it includes a broader universe of small, mid and large cap stocks and is therefore more diversified. The SPY ETF contains the 500 largest companies by market capitalization. Here is a historical chart of these 2 ETFs:

Once you have finalized your universe you need to think about how much capital to allocate to each asset.

Example allocation:

| Asset | Allocation % |

| US equities | 50% |

| US government bonds – long term | 7.5% |

| US government bonds – medium term | 7.5% |

| Developed Market Equities | 10% |

| Emerging Market Equities | 10% |

| Emerging Market Bonds | 5% |

| Gold | 5% |

| Real Estate Investment Trusts | 5% |

| Total | 100% |

These are arbitrary allocations without any science behind. Let’s simulate how a portfolio comprising these assets using specific ETFs would perform with those allocations. Please note that the result is not directly comparable with the previous simulations as it has a shorter history given that some of the selected ETFs have not been around that long.

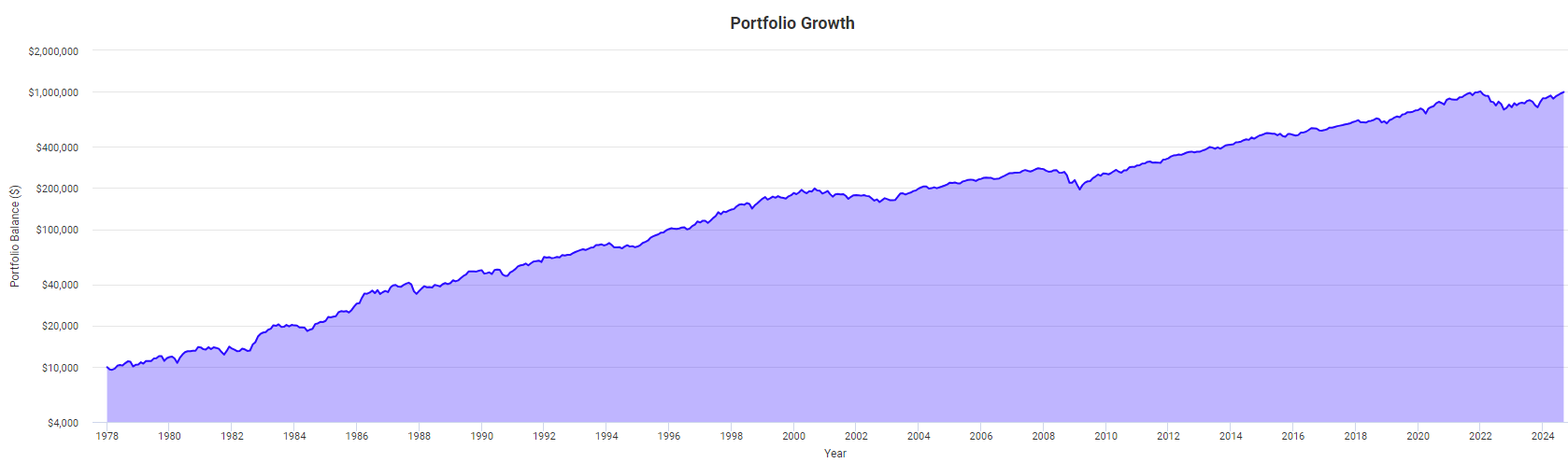

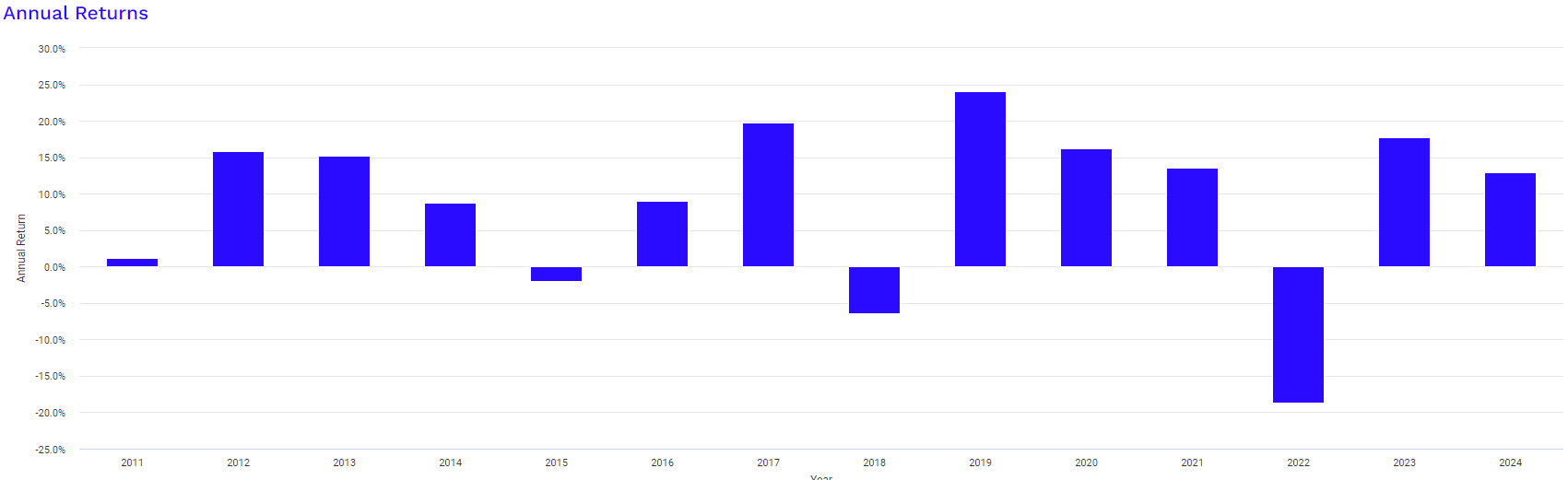

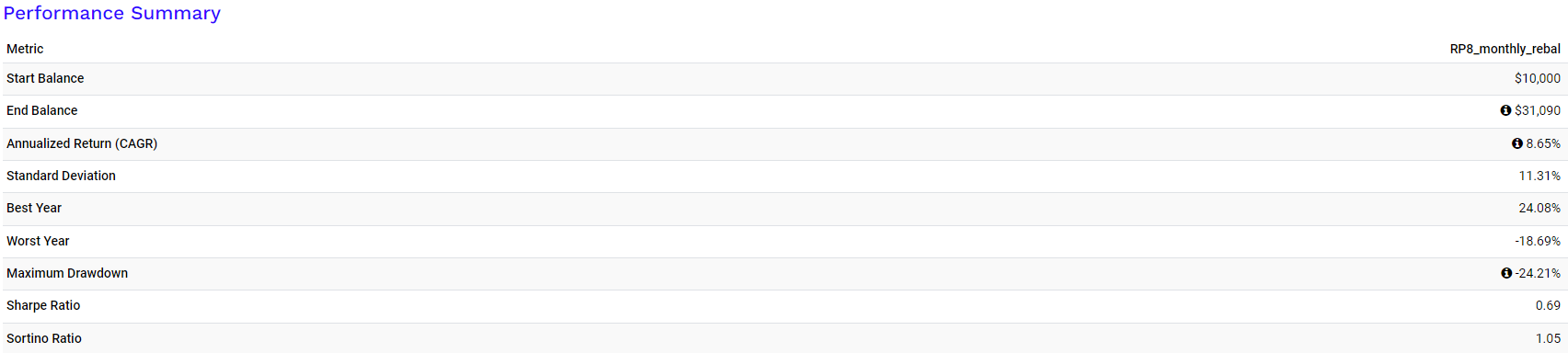

Here are the results for these eight assets with monthly rebalancing back to the target weights:

What do you think? The portfolio has achieved an annualized return of 8.7% with a standard deviation of 11.3% and a maximum drawdown of 24.2%:

Assuming you are comfortable with these results, you now would have to think about how you allocate your capital to this portfolio. You could either invest an initial lump sum and then just periodically rebalance the portfolio or you could continuously invest by injecting additional capital on a regular basis, otherwise known as Dollar Cost Averaging (DCA). This depends on your personal preferences and comfort level. For me DCA is the way to go.

Let’s say you just want to invest an initial lump-sum and then limit yourself to a regular rebalancing every month, quarter, or year. One more thing you need to think about here is sizing. Are you comfortable to just go with the periodic rebalance or should you consider cutting size at times and keep some of your capital in cash. This goes back to market timing which is very difficult (or impossible) and you run the risk on missing the big days. If you are comfortable stomaching volatility like I am, you might just keep going and not cut size, but this is a very personal preference and there is no right or wrong answer. In any case don’t go all cash every. You should always stay invested because only then you will be rewarded over time. If this is uncomfortable, think again. You are getting paid for this discomfort. If it were comfortable, everyone would do it.

Another thing to think about is how often do you want to rebalance your portfolio? On the one hand, you want to maintain the allocations you are comfortable with. On the other hand, every time you trade you incur cost. The more you trade, the more you pay. So be mindful about the frequency of your rebalancing. Your broker would be happy if you trade a lot, but you will not benefit from it. I used to rebalance my portfolio once a month but nowadays I rebalance only quarterly or even half yearly.

There are different ways to rebalance. You could for example just rebalance to your target weight at a frequency you are comfortable with. Or you could determine a band around your target allocation (e.g. +/- 3%) and only rebalance if the price is outside the band. This again depends on your comfort level but also on the pricing model you are on with your broker. It might be more efficient to have smaller transactions but more often to stay within a band instead of rebalancing less often back to the target weights.

Conclusion

It won’t get easier than this and you should not overthink this. Keep it simple and use your remaining resources for other potential strategies complementing your risk premia portfolio. Most importantly: do now just believe what I am writing here but do your own research. Make use of the available information and tools to decide whether this makes sense to you and you are comfortable putting your hard-earned money into it. If you are comfortable, get started. Maybe not with 7 – 8 assets but with 2 – 3.

How you practically get started? Once you have selected your universe, identify suitable assets for each class, like the aforementioned VTI and SPY ETFs. Look for highly liquid ETFs with low expense ratios and physical replication. There are other ETFs which use leverage you might want to consider later if you do not have a margin account. If you are new to this, I would recommend staying away from those. Whatever ETF you pick, make sure you read the details before you buy any of them. This applies to any asset you are planning to buy. Never buy an asset or financial product you do not understand. The information is available, you just need to find it and make sure you understand it.

In future posts I will delve deeper into other considerations of risk premia harvesting such as different approaches to portfolio construction.

Be disciplined, by systematic, and stay cool. Never panic!