Introduction

Bayes’ reasoning is a powerful tool for decision-making under uncertainty. It’s used not just in statistics but also in various fields like medicine, artificial intelligence, economics, and investing. The crux of Bayes’ reasoning is updating your prior beliefs as new evidence becomes available. It’s a dynamic approach that improves decision-making accuracy over time. Whether it’s predicting outcomes in daily life or making financial decisions, Bayes’ reasoning plays an essential role in processing information effectively and acting on it rationally.

Part 1: What is Bayes Reasoning?

Bayes’ reasoning is based on Bayes’ Theorem, a fundamental mathematical principle in probability theory describing how to update the probability of a hypothesis as more evidence becomes available. It was developed by the 18th-century mathematician Thomas Bayes and has since become one of the cornerstones of modern probability and decision theory.

Understanding Bayes’ Theorem

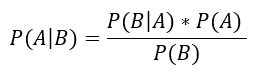

Bayes’ Theorem provides a formula for updating the probability of a hypothesis, based on new evidence:

Where:

- P(A|B) is the posterior probability: the probability of hypothesis A being true given the evidence B.

- P(A) is the prior probability: the initial belief about the probability of A before seeing the evidence.

- P(B|A) is the likelihood: the probability of observing evidence B given that A is true.

- P(B) is the marginal likelihood: the total probability of observing the evidence B under all possible hypotheses.

Bayes’ reasoning allows you to refine your understanding of the world by continually incorporating new evidence. You start with a prior belief or hypothesis, observe new data, and then adjust your belief accordingly. This continuous process makes Bayes’ reasoning particularly useful for decision-making under uncertainty.

How Bayes’ Reasoning Works

Let’s break down the mechanics of Bayes’ reasoning:

- Start with a Prior Belief: Before any new evidence is observed, you have a prior belief based on existing knowledge. For example, if you’re a doctor diagnosing a patient, you might believe the probability of the patient having a certain disease is low based on its rarity in the population.

- Receive New Evidence: You then gather new evidence. In our medical example, this could be the results of a diagnostic test.

- Update the Probability: Bayes’ Theorem helps you update your prior belief based on the new evidence. If the test result is positive, you’ll increase the probability that the patient has the disease. But crucially, this adjustment considers both the reliability of the test and the prior likelihood of the disease.

The flexibility of Bayes’ reasoning allows it to be applied to a wide range of fields, whether you’re predicting market movements, diagnosing medical conditions, or simply making decisions in day-to-day life.

Part 2: The Role of Bayes Reasoning in Day-to-Day Life

Bayesian thinking is not limited to complex mathematical problems; it plays a significant role in the everyday decisions we make, often without us even realizing it. Here are a few common applications:

Decision-Making Under Uncertainty

In our daily lives, we’re constantly making decisions with incomplete information. Whether it’s deciding if you should bring an umbrella based on a cloudy sky or determining whether to invest time in a new skill, we rely on our prior experiences and new information to guide us.

For instance, imagine you’re deciding whether to go for a run in the park, but the weather is unpredictable. Initially, your belief might be that there’s a 50% chance of rain. If you check a weather app that predicts rain with a 70% probability, you’ll update your belief based on that new evidence. Bayes’ reasoning helps you rationally adjust your decision by integrating both prior knowledge (your own observation of the weather) and new information (the forecast).

Medical Diagnosis and Personal Health

Bayesian reasoning is also commonly used in medical decisions. When doctors assess symptoms, they start with a prior belief about the likelihood of different conditions based on prevalence and patient history. As they receive more evidence—lab results, imaging scans, or patient responses—they update the probabilities and refine their diagnosis.

Similarly, individuals use Bayesian reasoning to assess their own health risks. If you have a family history of heart disease, your prior belief in your own risk may be higher. However, if new test results show normal cholesterol levels and good cardiovascular health, Bayes’ reasoning allows you to adjust your personal risk assessment, leading to better health decisions.

Everyday Risks and Rewards

Bayes’ reasoning also helps in everyday risk assessment, whether consciously or unconsciously. For example, if you’re considering switching jobs, your prior belief might be that a new company offers better opportunities. But as you gather new information such as insights from current employees or details about company culture you will update your assessment, helping you make a more informed decision.

Even mundane activities like choosing where to eat, buying insurance, or deciding the best route to work involve Bayesian updates as we process new information about risk, cost, or convenience.

Part 3: The Role of Bayes Reasoning in Long-Term Investing and Short-Term Active Trading

Bayes’ reasoning can be useful when applied to investing. Whether it’s long-term investing or short-term trading, Bayes’ Theorem provides a systematic way of updating beliefs and adapting strategies based on new market data. Let’s explore how Bayes’ reasoning operates in both scenarios.

Long-Term Investing

Long-term investing generally involves placing bets on an asset’s ability to appreciate over time. However, markets are constantly shifting based on economic conditions, corporate performance, and global events. This introduces a great deal of uncertainty, making Bayes’ reasoning especially useful in refining long-term strategies:

- Portfolio Management

Bayes’ reasoning allows investors to adjust their portfolios in response to new economic data or company performance. For instance, an investor may hold a belief that a particular stock will perform well based on the company’s growth trajectory. But as new earnings reports come in or macroeconomic conditions change, Bayes’ reasoning helps the investor update their belief about the stock’s future performance.

In long-term investing, Bayesian reasoning also helps investors avoid biases such as the confirmation bias where they might only seek out information that confirms their initial beliefs. By consistently updating probabilities based on objective new evidence, Bayesian investors make more rational and less emotionally driven decisions.

- Risk Management

Bayesian reasoning is also valuable in risk management. Investors can adjust the probability of various market outcomes (such as recessions or bull markets) as new data becomes available. For instance, if inflation rates rise, an investor using Bayes’ reasoning would adjust their portfolio to reflect the increased risk of inflation-driven market corrections.

Moreover, in constructing a diversified portfolio, investors can use Bayesian reasoning to continuously update their understanding of asset correlations, market volatility, and expected returns, helping them make better allocation decisions over time.

Short-Term Active Trading

Short-term traders face even greater uncertainty, as market movements can be swift and unpredictable. Bayesian reasoning provides a framework for traders to dynamically adjust their strategies based on new price movements, market trends, and technical indicators.

- Technical Analysis

While I am not a fan of Technical Analysis I am including this here since many other traders are using TA in their trading. Many short-term traders rely on technical indicators (such as moving averages or relative strength indices) to make predictions about asset prices. In a Bayesian framework, traders start with a prior probability about a market trend (for example, that a stock price will rise) and adjust that probability as new data (such as price changes or volume spikes) becomes available.

For example, a trader might believe there’s a 60% chance that a stock will continue trending upward based on a moving average crossover. However, if new news about the company is released – such as a profit warning – the trader would use Bayesian reasoning to update their belief and adjust their position accordingly.

- Event-Driven Trading

Bayesian reasoning is particularly useful in event-driven trading, where traders attempt to profit from market volatility triggered by events like earnings announcements, interest rate changes, or geopolitical developments. In this context, traders start with an initial hypothesis about how the event will impact the market, but as more details of the event unfold, they update their trading strategy using Bayes’ Theorem.

For instance, in the lead-up to an earnings report, a trader may have an expectation of how a company will perform based on analyst forecasts. However, once the report is released, the trader updates their belief based on the actual results and market reaction, refining their trade decisions in real time.

- Reducing Overconfidence and Cognitive Biases

Bayesian reasoning also helps short-term traders reduce overconfidence bias, which is the tendency to overestimate one’s ability to predict market movements. By constantly updating probabilities as new information comes in, Bayesian traders are less likely to fall into the trap of overestimating their knowledge or ignoring contradictory evidence.

Conclusion

Bayes’ reasoning is a powerful and flexible tool for decision-making in uncertain environments, whether in everyday life or the world of finance. By helping individuals continuously update their beliefs based on new evidence, it provides a systematic framework for improving the accuracy and rationality of decisions.

In day-to-day life, Bayes’ reasoning allows us to make more informed choices, from health decisions to risk assessment in uncertain situations. In investing, Bayes’ reasoning plays an essential role in both long-term portfolio management and short-term active trading by enabling investors to refine their strategies and manage risk in a dynamic market environment.

Ultimately, Bayes’ reasoning serves as a reminder that the world is uncertain and that the best way to navigate uncertainty is to remain open to new information, updating our beliefs and strategies as reality unfolds. By applying Bayesian thinking, individuals and investors alike can make smarter, more rational decisions that lead to better outcomes over time.

For an excellent visual explanation of Bayes’ Theorem have a look at the 3Blue1Brown YouTube video “Bayes theorem, the geometry of changing beliefs” (I would highly recommend anyone interested in mathematical subjects to subscribe to the 3Blue1Brown YouTube channel):