Save or Spend? Helping Kids Make Smart Money Choices

👨👩👦 A Note to Parents

Once your child starts receiving a regular allowance and learns that money can grow (thanks to the magic of compounding), the next natural step is helping them decide what to do with their money.

Should they spend it now on something fun? Or should they save it for something bigger later?

This simple – but powerful – question lies at the heart of financial decision-making, and learning to think it through at a young age helps children build confidence, patience, and planning skills. This article introduces the idea in a way that kids aged 7 – 8 can understand.

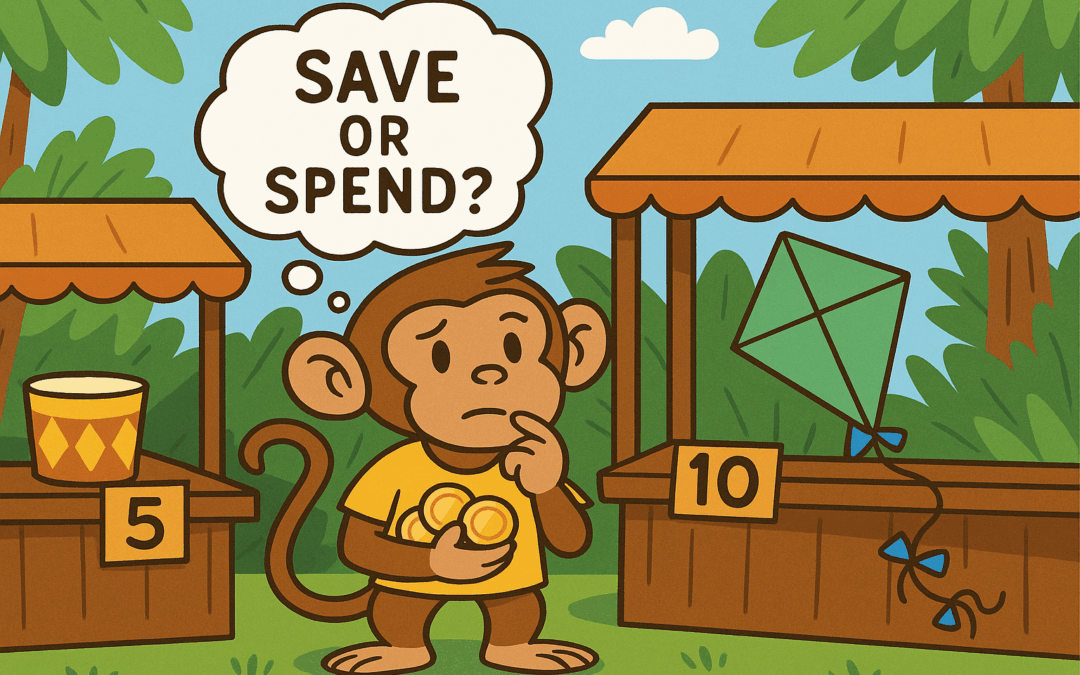

🐵 A Story for Kids: Stoffel’s Dilemma at the Jungle Market

Stoffel the Monkey was feeling proud. He had saved up 7 shiny banana coins from his weekly allowance. Today was market day in the jungle, and he was ready to spend!

As he wandered the stalls, two things caught his eye:

- A mini jungle drum for 5 coins. It made cool noises and had a banana pattern.

- A super jungle kite for 10 coins. It soared high above the treetops and glowed in the sun.

Stoffel had a problem: he didn’t have enough coins to buy both.

He could:

- Spend 5 coins now on the drum and keep 2 coins for snacks.

- Or save all 7 coins, wait two more weeks, and get the kite.

“What should I do?” Stoffel asked his friend, Lila the Parrot.

Lila squawked, “Well, it depends! Do you want something fun right now, or something amazing a little later?”

Stoffel thought hard. The drum would be fun today…but the kite would be epic. He decided to save.

Three weeks later, Stoffel had 11 coins. He bought the kite and a mango smoothie – and watched the kite soar into the sky with a proud, happy grin.

🧠 The Big Idea

Sometimes we want something right now. That’s called spending.

Other times, we want to wait and save for something better or bigger. That’s saving.

Both are okay! But smart money monkeys like Stoffel think before they decide.

💬 How to Talk to Your Child

-

“What do you want to spend your money on this week?”

- “Is there something bigger you want later?”

- “How would it feel to wait and save for it?”

- “Is there a way to do both – spend a little and save a little?”

🎒 Try This at Home

- Create a Save or Spend Jar System

Give your child two jars:

- Spend Now (for small treats or toys)

- Save for Later (for bigger dreams)

Let them decide how much of their allowance goes into each jar each week or give them a fix ratio to split their allowance.

- Build a Goal Tracker

Print or draw a simple tracker with a picture of the goal (e.g. a toy, book, or outing). Each week, they fill in progress toward that goal.

Example:

- Goal: $20 for a LEGO set

- Weekly savings: $5

- Tracker shows 4 coins to reach the goal

- Ask Reflective Questions

After a spending or saving decision, talk about how it felt:

- “Are you happy you spent it?”

- “Do you wish you had saved more?”

- “What would you do differently next time?”

This reflection builds awareness and confidence in decision-making.

🧭 Final Thought

Kids don’t need to always save or always spend. The key is helping them pause and think – and recognize that every coin has a choice attached.

When they understand the trade-off between spending now and saving for later, they begin developing the mindset that builds lifelong financial resilience.

This is the first article in the StoffelWealth miniseries “Money Foundations for Kids”. Click on the following links to read the other parts:

Part 2: Needs vs Wants: Helping Kids Make Smart Money Choices

Part 3: What Is a Budget? (For Kids!)

Part 4: Where Does Money Come From? (And Why It Doesn’t Grow on Trees)

Save or Spend worksheet

Download the “Save or Spend worksheet” to help your kids keep track of their saving and spending plans.